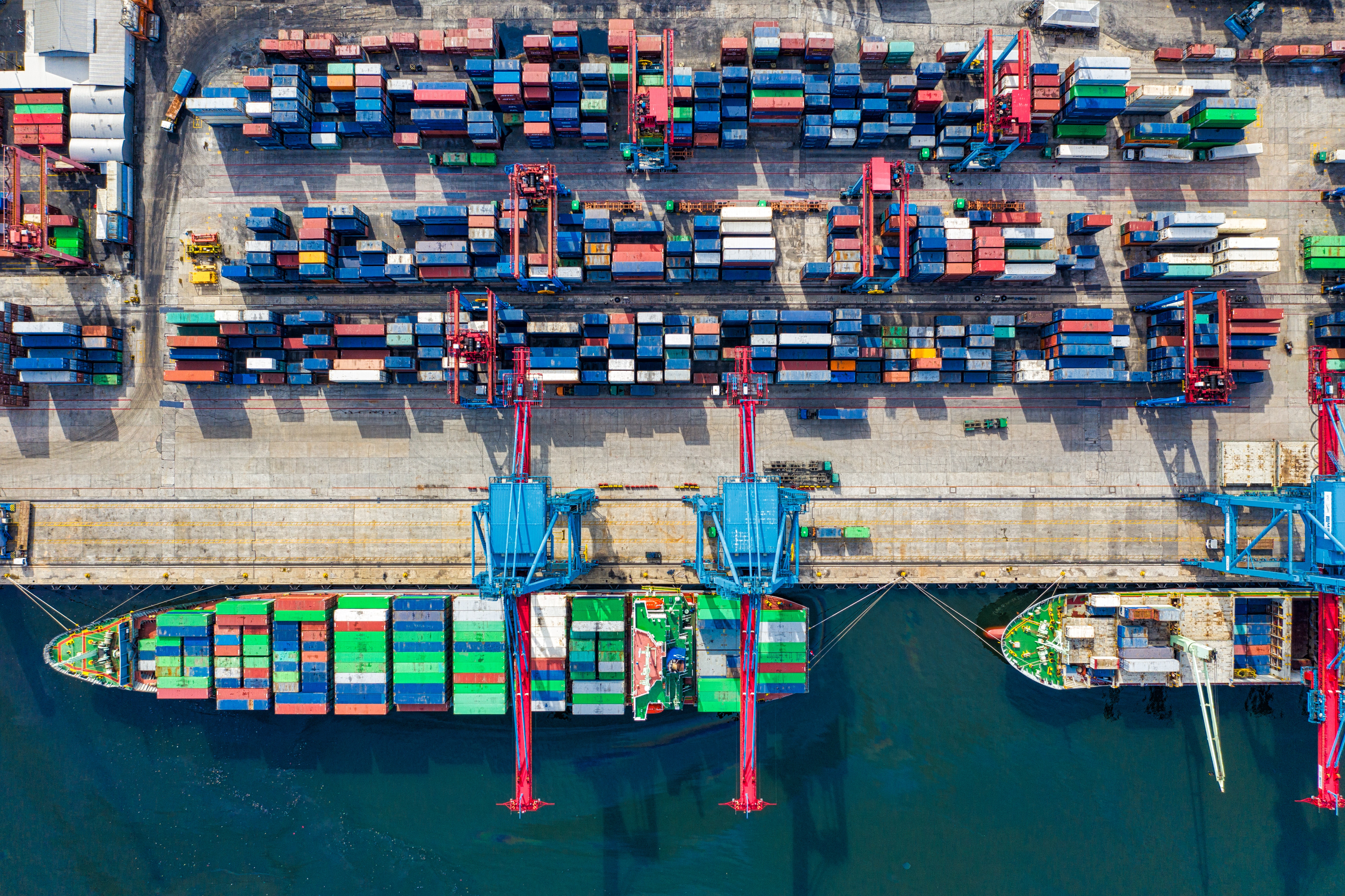

An estimated $350 billion of invoices are typically involved in supply chain finance programs. Known as "reverse factoring," this process assists suppliers in obtaining the capital needed to keep supply chains humming, as described by Aite Group. Opposed to traditional receivables financing or factoring, reverse factoring is driven by the buyer and its relationship to a bank or finance provider, with capital being made available to suppliers based on the relationship parameters.

Banks are happy to step in, within specific jurisdictions and credit profiles. Research firm Coalition reports that banks logged approximately $12.7 billion in revenue in the first half of 2020 via total supply chain finance volumes. However, limitations are significant, and often times, the suppliers that need financing the most are excluded from such programs.

Read More

Topics: ERP, Fashion & Retail, Distribution, Supply Chain, Fashion & Apparel, Supply Chain Visibility, Supply Chain Network, Cloudsuite Fashion & Apparel, Infor CloudSuite PLM for Fashion, Infor CloudSuite Fashion PLM, Enterprise Software, Retail Supply Chain, Infor CloudSuite Fashion, Supply Chain Operations, Supply Chain Management, Infor CloudSuite M3, Infor CloudSuite ERP

Regardless of size or industry, asset-intensive organizations are always looking to do more with less. For a food and beverage manufacturer that means finding ways to extend asset life to minimize costs, improve food and worker safety and reduce waste while performing the right maintenance on the right equipment, at the right moment to avoid downtime.

Some businesses have been making do and getting by with asset management strategies that sell them short, driving up the cost of maintenance labor and materials and increasing the risk that critical assets will be down when they’re most urgently needed. The scene has been shifting over the past several years, with Enterprise Asset Management (EAM) offering greater visibility and sophistication for maintenance operations.

But business rarely sits still for very long. And with the rapid rise of Industry 4.0, it’s essential for asset management to keep up. Maintenance 4.0 is the set of tools and strategies that is helping food and beverage companies optimize operations by deploying the mountains of data now available to keep equipment and production lines in peak operating condition. Infor’s Best Practice Guide, “Why your EAM strategy must evolve to increase food safety,” explains how it works and lays out the five essential components of an Asset Performance Management (APM) platform.

Read More

Topics: ERP, Distribution, Supply Chain, Warehouse Management Systems, Supply Chain Network, Cloud BI, Enterprise Asset Management, Enterprise Software, WMS

Automotive manufacturers and their suppliers continue to increase their collaboration in various ways, whether this be through robotic process automation (RPA), data collection and exchange, or other methods that provide insights for scalability. With true, multi-enterprise collaboration, there are cross-training opportunities to convey customer needs and preferences for product innovation, giving manufacturers the ability to make rapid adjustments in real time. Collaborative behavior makes this happen, and it all starts with transparency.

However, building real trust, collaboration, and transparency goes beyond using a specific technology or workflow. At its core, this is about changing the culture of automotive OEMs and throughout their suppliers at every tier. Automotive companies who are true leaders in the industry consider the health of the entire supply network, not just their immediate interests. Making this change—as with almost all substantive transformations—requires change be from the top executive level down.

Read More

Topics: ERP, Manufacturing, Distribution, Supply Chain, Supply Chain Visibility, Supply Chain Network, Industrial Manufacturing, Cloud BI, Enterprise Asset Management, Enterprise Software, Supply Chain Operations, Supply Chain Management, Infor CloudSuite M3, Infor CloudSuite ERP

Disruptions to the supply chain

If any event reveals the need for resilient supply chains, it’s COVID-19. The disruptions shook every industry, including automobile. Early 2020 forecasts projected a significant drop in new vehicle sales, but ultimately turned out much better with only a 15% reduction from the total 2019 sales.

It’s no surprise the pandemic has prompted several automotive companies to embrace new supply chain strategies that allowed them to recover quickly while also setting them up for future growth. Many automotive companies stood up crisis teams and control towers to improve visibility and maintain profitability, which in turn developed into an advanced strategy around predictive risk management and multi tier supplier collaboration.

Even with the automotive industry embracing new supply chain practices, another disruption has risen in the semiconductor chip shortage. With modern vehicles often containing thousands of semiconductors, this crisis underscores another dimension of supply chain risk exposure and highlights the critical need to collaborate with multi tier partners for globally limited supplies.

Read More

Topics: ERP, Distribution, Supply Chain, Supply Chain Visibility, Supply Chain Network, Cloud BI, Enterprise Asset Management, Enterprise Software, Supply Chain Operations, Supply Chain Management, Infor CloudSuite M3, Infor CloudSuite ERP

No vertical market appears to be immune to the hardships and challenges resulting from the unprecedented uncertainty and volatility of today’s geopolitical strife, climate disasters, and global pandemics. Which makes it even that much more challenging for organizations to try to meet consumer preferences and requirements that are always changing.

All of this uncertainty underscores the importance for organizations to focus on optimizing all facets of their supply chain costs—including cost-to-source, cost-to-procure, cost-to-manufacture, logistics, and handing. Supply chain optimization must also factor in the direct labor that drives supply chain activities in manufacturing, distribution, and retail. Total cost has never been more critical to understand and control—regardless of an organization’s industry or sector.

Read More

Topics: Supply Chain, Supply Chain Visibility, Supply Chain Network, Retail Supply Chain, Supply Chain Management

B2B transaction data from the Infor Nexus network shows a major shift in supplier payment terms following the onset of COVID-19 in March of 2020. In the first three months of last year, the majority of payment terms were 30-45 days. In March, 66% of all orders were on terms less than 60 days.

By July, the buyer-supplier payment dynamic had completely flipped, with 65% of orders on terms greater than 60 days. This trend continued throughout the year with 60 day, 90 day, or even longer payment terms in place as buyers moved to preserve their own capital. As a result, many suppliers found themselves in need of a lifeline. For many buyers and suppliers, supply chain finance programs became that solution, removing risk and stress from supply chains by ensuring suppliers access to early payment.

Read More

Topics: Manufacturing, Distribution, Supply Chain, Supply Chain Network, Enterprise Software, Supply Chain Operations, Supply Chain Management

Digital technology is changing the world, one industry at a time. With these changes comes a reimagining of the supply chain, from the systems businesses use to communicate and interact, to the strategies they deploy to move goods around the world. Along the way, our expectations for speed, service, and quality go up, forever altered.

Digitalization gives rise to new business models, in which real-time connectivity, greater visibility, reactivity, and anticipation become the underlying characteristics of our supply chains. But this kind of change isn’t easy, and transformation doesn’t happen overnight. While many businesses have adopted technology to augment or enhance existing processes, they’ve still got a long journey ahead.

By taking a staged approach to digital transformation, and building greater connectivity across the supply chain, businesses can pave the way toward a fully-connected future, while still being able to tackle the biggest challenges they face right now.

Read More

Topics: Digital Transformation, Supply Chain Network, Industrial Revolution

The year 2020 approaches with promise amidst a backdrop of innovation and transformation occurring at a speed never witnessed before. We’re experiencing a digital revolution that is changing the way we live, work and interact with one another. The power of information is just beginning to blossom as more of our decisions are based on data and use cases for artificial intelligence are delivering significant value. Meanwhile, global movements to protect the planet and operate responsibly continue to grow in importance. And an undercurrent of de-globalization continues to change the way countries and companies interact with each other.

Here’s a look at some of the emerging trends and themes you can expect to take shape in 2020.

Read More

Topics: Digital Transformation, Supply Chain, Supply Chain Network, Technology, Sustainability

For the longest time, procurement and supply management teams have focused on cost-savings and providing accurate supply for their businesses. More specifically, their value was primarily limited to efficiency (the minimization of cost for procurement services) and effectiveness (the maximization of business value). In recent years, there is an increased focus beyond price reduction, with concentration towards contribution to total cost of ownership (TCO), and the management of overall value and demand.

Today, it’s about the value experience: the optimization of procurement relationships, engagement and collaboration for employees, customers and suppliers. In doing so, start to consider ways procurement and supply management teams provide value to the rest of the organization, outside of cost cutting.

Read More

Topics: Supply Chain, Supply Chain Network

This time last year, we looked at the Fashion Revolution movement and its clarion call for transparency across fashion supply chains. Since then, the movement has gained even more momentum; 2017 numbers reflect greater participation on social media with more consumers asking #whomademyclothes, and more workers posting photos of themselves replying, #imadeyourclothes.

Crucially, more brands are responding to the demand for transparency. 2017’s Fashion Revolution Week had over 1,000 mainstream clothing brands respond to #whomademyclothes, up from around 400 the previous year. It’s a safe bet that this form of engagement will keep growing in the coming years. So the real question becomes, what’s next?

Read More

Topics: Fashion & Retail, Fashion & Apparel, Supply Chain Visibility, Supply Chain Network