At a recent Infor webinar they discussed the importance of new and revised products to a food company’s revenue and bottom-line growth. Successful product innovation, though, has never been more complex as consumers’, customers’ and regulators’ expectations continue to evolve and expand. And this is not just a challenge for your R&D department. It expands across all disciplines from procurement to production to marketing.

A Fresh Look At Bringing Product Innovation To Market.

Topics: Food & Beverage, Infor M3, Infor Optiva, CloudSuite Food & Beverage

Is There An Unrelenting Collapse Of The Middle In Retail?

We thought this was an interesting article. Published by Forbes this month it talks about how it’s a virtual certainty that this year will end with physical stores sales not only being up year over year (again) but also, according to eMarketer, contributing more incremental sales growth than e-commerce.

Great news but for all retailers? Here's what Mitchell Chi, ICCG's General Manager - Americas, Enterprise Software has to say...

My thoughts about the collapse of the middle…

Did you know that 83% of retail shoppers enjoy socializing with friends centered on physical stores? Some retailers, when pressured to increase margins, focused on cutting wages, training and staff. They shifted spending to store displays, traditional advertising, and a poor product assortment. These retailers deserved to die. Good riddance.

But all of this makes the mid-market ripe for a low cost, “social retailer.” One like Primark. Great selection, well trained staff and FUN. My go to store for weekend, lay around the house clothing.

Topics: Retail, Infor M3, Retail Trends, Online Retail, CloudSuite Retail, Cloudsuite Fashion & Apparel, CloudSuite PLM

10 Reasons To Upgrade To The Latest Infor Fashion PLM

The latest release of Infor Fashion PLM offers new tools to help you plan, develop, comply, approve, and collaborate with partners in the design and pre-production process. In addition, the new Fashion PLM Cloud Edition offers a multi-tenant solution built on the Infor OS platform, which also leverages Infor ION and Infor Ming.le for seamless and social collaboration.

We've highlighted ten reasons that your company should upgrade to the latest version of Infor Fashion PLM. Continue reading the blog to learn.

Topics: Fashion & Apparel, Fashion PLM, Cloudsuite Fashion & Apparel

M3 Food & Beverage is a comprehensive ERP solution designed to help food and beverage companies respond to changes in customer demands, manage their global supply chains, plan for seasonality, and reduce waste.

Infor M3 Food & Beverage is the industry's most complete solution dedicated to solving the unique challenges of the food industry, including shelf-life, yield; reverse bill of materials, attribute management, grower accounting, and comprehensive asset management.

Topics: Food & Beverage, Infor M3, PLM, Infor Optiva, CloudSuite Food & Beverage

Establish a foundation for digital transformation:

With the world changing faster than ever before, companies need to keep up by becoming more agile and adopting new technology to stay competitive and stand out from the competition. Moving to the cloud is one way that can help you stay ahead.

Infor M3 Cloud delivers software as a service, offering complete flexibility in operations, technology, and scale. As a multi-site, multi-country, and multi-company ERP solution, M3 Cloud empowers your organization to easily adapt to changing business needs.

Topics: Manufacturing, Fashion & Retail, Food & Beverage, Infor M3

How Infor Food & Beverage Facilitates FSMA Compliance

The FDA Food Safety Modernization Act (FSMA) requires that food and beverage companies take a more proactive approach to food safety. This is a shift from the more reactive approach that food and beverage companies have historically followed. With FSMA in place, companies must identify risks, create procedures for mitigating hazards, and execute against those procedures to ensure all threats to the safety of the food supply chain are contained, as well as demonstrate that their programs are valid and that they are continually being improved upon.

Topics: Food & Beverage, Infor M3, Infor Optiva, FSMA

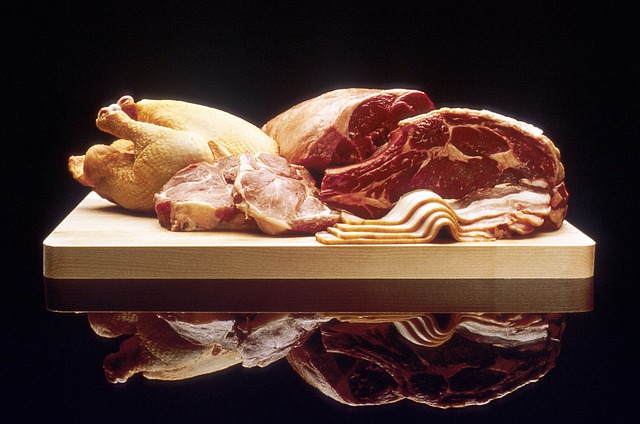

Infor Food & Beverage For The Meat And Poultry Industry

Today's consumers are better informed than ever before. As a protein producer, you must make cost-effective decisions about how you offer quality food -- before the first cut is made. To meet consumer demands, you must process meat and poultry in a manner that is ethical, humane, and efficient. With Infor Food & Beverage for the meat and poultry industry, you get the most powerful, purpose-built, and complete suite of solutions developed specifically for meat and poultry manufacturers so you can do just that.

Topics: Food & Beverage, Infor M3, Infor Optiva, CloudSuite Food & Beverage

5 Ways To Fast-Track The Design To Sales Process.

Trying to keep up with endlessly changing trends and demands in the global fashion market puts fashion companies under enormous pressure to create innovative products at a moment's notice.

But when it takes the average fashion company six months to go from design to sales floor, some companies find they're always chasing after the industry leaders that can get new products on the racks in as little as 15 days.

Topics: Fashion & Apparel, Fashion PLM, Cloudsuite Fashion & Apparel

Although most of the growth in retail is happening online, physical retail often still represents 90% of a retailer’s sales. One way to leverage existing physical locations and provide a more efficient experience for customers is to support “Buy On-line, Pick-up In-Store,” or BOPIS for short. Customers do their research online, select their products, and later pick up the items at a physical store. However, the road to supporting BOPIS has many pitfalls to avoid. We’ve collected 10 common BOPIS issues that smart retailers should address, before their omni-channel evolution leaves their customers wanting more.

Infor's Matt Jones discusses three major causes at the root of these BOPIS boo-boos, that are creating a negative customer experience and impacting the retailer’s profitability. They are:

Topics: CloudSuite Retail, Retail Demand Management, Buy Online, BOPIS

Caroline Fairchild, LinkedIn Managing News Editor, reached out to me and other LinkedIn members to help add informed perspectives on the day’s news and trends. She asked:

"Why do you think there is a disconnect between public perception of female leadership skills and what has been proven in the American workplace?"

Here is what I shared:

“In the future there will be no female leaders. There will just be leaders.”

I agree with the author of this quote, Sheryl Sandberg, Facebook COO, but to get to that day, a lot of change has to happen and corporations and business leaders need to step up and take meaningful steps and action towards greater female representation in leadership roles.

In our company we have found that gender and cultural diversity helps us succeed in extraordinary ways – especially revenue performance. But there are other benefits, too. Companies that are leading the efforts are my role models and they are gaining momentum by being recognized and admired for their leadership.

Change takes time and commitment. As today’s leaders, we need to look at what can be done to encourage the next generation of girls to become strong leaders too.

Topics: Women in Manufacturing, Leadership, Women in Business